The short answer is, never – there is never a good time to move your stop loss to breakeven. Better yet, it is never logical nor strategic to move your stop loss to breakeven.

Of course, I realize that “never” doesn’t make for a very informative lesson. Therefore I have decided to expand on that idea with some basic principles as well as an example from a recent trade I took.

In this lesson, you will learn why it never makes sense to move your stop loss to breakeven. We will discuss the implications of doing so and finish off with a better, more strategic approach to managing risk as a Forex trader.

A Flawed Stop Loss Strategy

Everywhere you turn in the Forex market there seems to be talk of moving stop losses to breakeven. It’s one of the more commonly discussed topics and arguably the most misunderstood in the world of trading.

The problem begins to surface when we look at why something is done. Why do most traders move to breakeven? Most who engage in the practice will argue that they do it to protect their capital, which by itself is a great reason to do anything as a trader.

But that doesn’t really answer the question. There are many ways to protect your trading capital. For example, remaining patient and taking only the very best setups will help protect your capital.

So again, why move your stop loss to breakeven? The real answer…

To prevent a loss, of course. It isn’t necessarily about protecting your capital, it’s about protecting your ego. Some may argue that point and your very own ego will try to displace it, but having traded several different markets since 2002 I can tell you that it’s a fact.

The option exists to move a stop loss 10 pips above or 10 pips below an entry price, yet traders still choose to move it to their exact entry price. This fact alone proves that for most traders, the motive to protect the ego from a loss is greater than it is to protect their trading capital.

The Market Doesn’t Care About You or Your Stop Loss

The whole premise of a stop loss is to get you out of a trade should the market invalidate the setup. This typically involves breaching a key high or low that you have designated as being critically important to the trade setup.

A stop loss placed at your entry price does none of that. Sure, it protects your capital, but a breakeven stop that is triggered does not invalidate the setup because the market doesn’t know where you entered, nor does it care.

Price action trading works because market participants from around the world see the same formation in real-time. A bull flag pattern typically breaks to the upside because enough traders see the same pattern and know that it means higher prices are likely on a break of resistance; also referred to as herd mentality.

You are the only person on earth who knows where you entered a trade. So when you move your stop loss to breakeven you are modifying your parameters based on a level that is specific to you rather than one that is universally important.

A Better Way to Manage Trading Risk

Rather than moving your stop to an arbitrary level, you should always aim to move it to a strategic level – one that the market has deemed important.

In fact, everything you do as a trader needs to be strategic. Everything from your entry to your stop loss to your take profit level; it all needs to be strategic and never arbitrary.

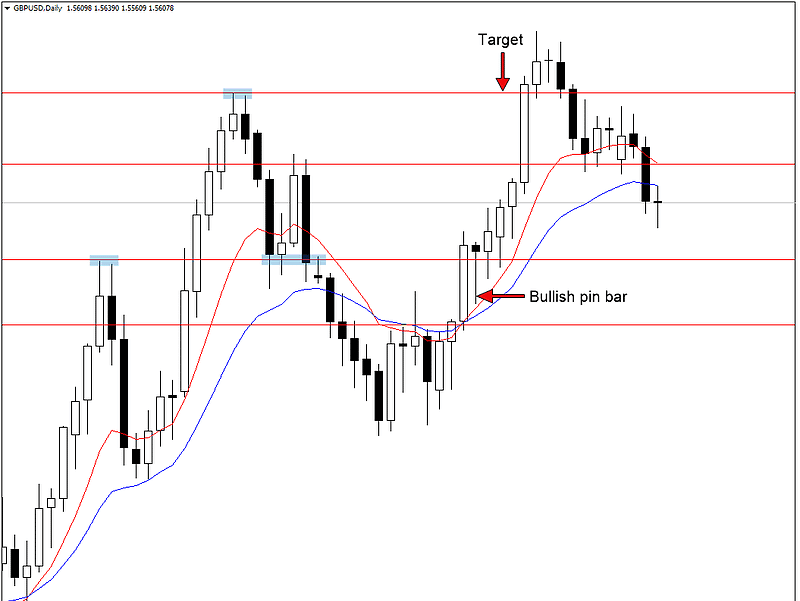

Let’s take an example. The GBPUSD daily chart below illustrates the setup.

As you can see from the chart above, GBPUSD formed a bullish pin bar after a daily close above a key horizontal level. Based on the structure of the setup, a buy order on a retest of the level as new support looked favorable.

Here is how the initial trade looked.

The chart above shows the long entry on a retest of the level as new support. Note that the stop loss was placed under the low of the bullish pin bar while the target was set at recent highs. This gave us a setup worth a potential 310 pips with a 90 pip risk (3.4R).

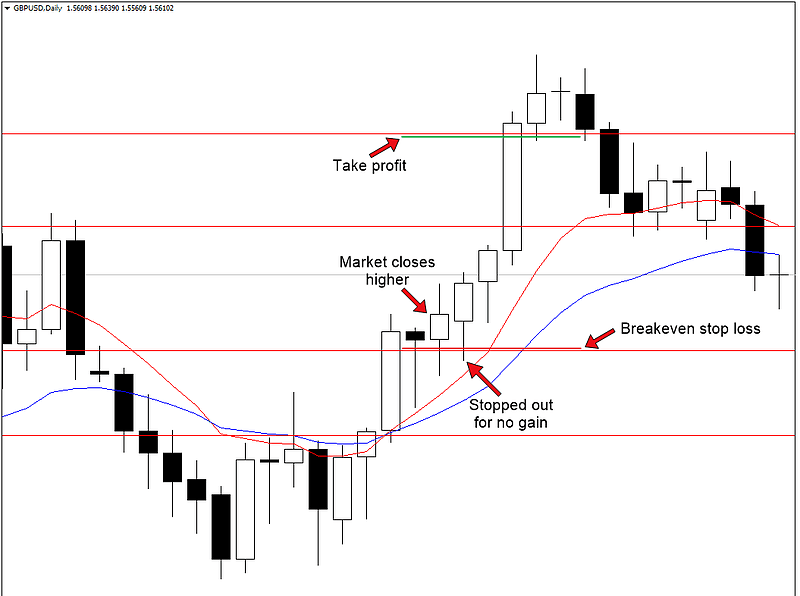

Now here comes the kicker. By the second day, the market had moved nearly 50 pips in our favor. Most Forex traders staring at 50 pips of profit instinctively want to move their stop loss to breakeven to “lock in profits”. And I’m sure some did on this particular setup.

However as I mentioned previously, a breakeven stop loss is more about protecting the ego from a loss than it is about strategically locking in profits.

Here is what happened to those who were quick to move to breakeven.

Although the market moved even higher on the third day, those who had moved their stop loss to breakeven were stopped out just before the market took off to the upside.

Does this look familiar? It was certainly a common occurrence for me when I started trading Forex back in 2007.

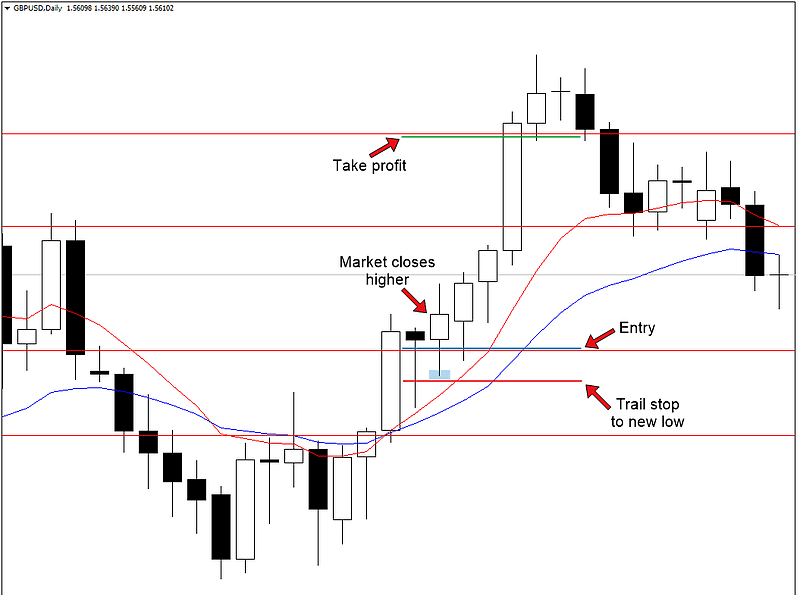

So what is this “better approach”, you ask?

It’s a way of trailing your stop loss at a level that has been defined by the market. In the case of the GBPUSD setup above, you would move your stop under the low of the second day.

Here is what that looks like.

Notice how in the chart above, the stop loss gets placed under the low of the second day. If the stop gets triggered here, we no longer want to be in this trade as it means the most recent low was taken out and thus further losses are likely.

The placement above also means that we were able to cut our risk in half. So if you were risking 2% of your account balance on the initial entry, by day two your risk was just 1%.

Not only that but by being strategic about the placement of your stop you were able to stay in the trade, thus netting 6.8% profit if risking 2%. Meanwhile, those trying to protect their ego from a loss came away with nothing.

Final Words

The idea of a breakeven stop loss is a flawed approach. Those who teach it like to think that it’s a sound method for risk management when in fact it only serves to protect their win rate – one of the more meaningless statistics for a trader.

Remember that once you enter a trade your entry price becomes trivial. All that matters from that point on is your target and an invalidation level, which is where the market needs to trade to invalidate the setup.

This invalidation level is the only area you should be concerned with when managing your stop loss. A strategic approach such as this will ensure that you are trading the price action on your chart rather than listening to your ego, which will get you in trouble every time.

Your Turn

Do you currently move your stop loss to breakeven? If so, do you see things a bit differently having read this lesson?

Share your experience or ask a question below. I look forward to hearing from you.

I have been a successful trader for close on 15 years now. I almost always move my stops to break-even once I have reached an initial target or price has closed beyond an important level. I will also do it if price HAS NOT reached that level should there be a major news event out. There is no ego in my approach. Ego left a long, long time ago.

This article is irresponsible and downright silly for new traders to follow, in particular. Break-even stops can tick you out early, but defending your account is the first thing you need to learn, profits come second.

I will only say this. I concur with Jeff’s comment 100% “This article is irresponsible and downright silly for new traders to follow!”

This approach works just fine for me !

Indeed I was first taught by other ” traders” to move your stop to break even when the market moved about 60 pips in your favour, which stopped me out frequently.

I was protecting my account but also no profits were made in the process.

By using the trailing stop method as described in the article, I give my trade more room to breathe using price action and I’m finally making money and progress. I also took this trade used in the example and it provided me with a 7R. I guess when you move your stop to break- even when an initial target has been hit your basically doing the same thing but on a bigger scale ? It has proven to work for me so I’m sticking with it.

My husband likes to put his S/L at break even after a certain amount of pips, and when he sees me trading, he always recommend to put my S/L on break even. I actually never want to do that, but because he makes me scared, saying:”you’re gonna ruin your account” i listen eventually. I wished I never listened to him :-D. So far, I missed a lot of good trades just because I listened to him.

I don’t think that there is a right or wrong answer when it comes to moving stops to breakeven.

Only what works for you and makes money.

As I see it, there are two possible reasons for moving a stop to BE…

1. You are moving your stop because you are nervous about protecting your 10 pips of profit. Like you mention above.

2. You have hit a solid first profit target and you want to protect the rest of your position.

So in reason #1, yes…it doesn’t make sense to move your stop. You are only cutting your profits short.

But let’s say that you have already bagged 2R on your first profit target and you are leaving at little on the table to try to pick up a runner. I believe that it makes a lot of sense to move the stop to breakeven or even slightly in the positive, when it makes sense.

Doing this often frees up a lot of mental capital that can be used on other trades. It really depends on your personality.

Cheers,

Hugh